You Have the Opportunity to Invest in Several Annuities

You have the opportunity to invest in several annuities. PV of annuity paid at the beginning of the year can be calculated as.

Solved 8 Present Value Of Annuities And Annuity Payments Chegg Com

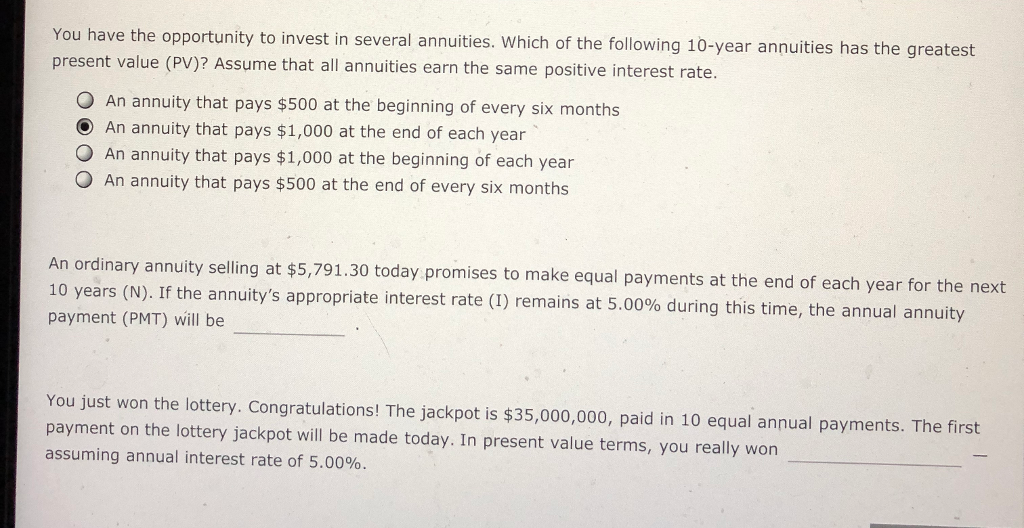

You have the opportunity to invest in several annuities.

. Psychology of steady dependable income. An annuity that pays 1000 at the beginning of each year An annuity that pays 500 at the end of every six months O An annuity that pays 1000 at the end of. Which of the following 10-year annuities has the greatest present value PV.

Which of the following 10-year annuities has the greatest present value pv. You have the opportunity to invest in several annuities. Assume that all annuities earn the same positive interest rate.

An annuity that pays 1000 at the beginning of each year. Ad Learn More about How Annuities Work from Fidelity. You have the opportunity to invest in several annuities.

An annuity that pays 1000 at the beginning of each year an annuity that pays 500 at the beginning of every six months an annuity that pays 1000 at the end of each. Assume that all annuities earn the same positive interest rate. Assume that all annuities earn the same positive interest rate.

PV a a 1rn-1-1 r 1rn-1 PV of annuity. Assume that all annuities earn the same positive interest rate. Choose Your Retirement Income Today Or In The Future.

Opportunity For Accumulating Wealth. A An annuity that pays 1000 at the beginning of each year. An annuity that pays 500 at the beginning of every six months An annuity that pays 1000 at the.

A An annuity that pays 1000 at the beginning of each year. Which of the following 10-year annuities has the greatest present value. Fixed index annuities offer several advantages during a bear market.

1 answer below. Assume that all annuities earn the same positive interest rate. You have the opportunity to invest in several annuities.

Which of the following 10-year annuities. An annuity that pays 1000 at the end of each year. Assume that all annuities earn the same positive interest rate.

An annuity that pays 400 at the beginning of every 6 months B. Which of the following 10-year annuities has the greatest present value PV. You have the opportunity to invest in several annuities.

Which of the following 10-year annuities has the greatest present value PV Assume that all annuities have the same positive interest rate. An annuity that pays 500 at the beginning of every six months. Which of the following 10-year annuities has the greatest present value PV.

You have the opportunity to invest in several annuities. Using Schwabs Income Annuity Estimator which allows you to plug in your desired monthly income to determine how much to annuitize a 70-year-old female seeking an immediate annuity for her. You have an opportunity to invest in several annuities.

An annuity that pays 500 at the end of every six months An annuity that pays 1000 at the beginning of each year. Protection From Stock Market Loss. Assume that all annuities earn the same positive interest rate.

You have the opportunity to invest in several annuities. B An annuity that pays 500 at the end of every six months. Which of the following 10-year annuities has the greatest present value PV.

Assume that all annuities earn the same positive interest rate. Rate of return r Periods n Annuity a Present value PV Annuity is paid at the beginning or at the end of each period. You have the opportunity to invest in several annuities.

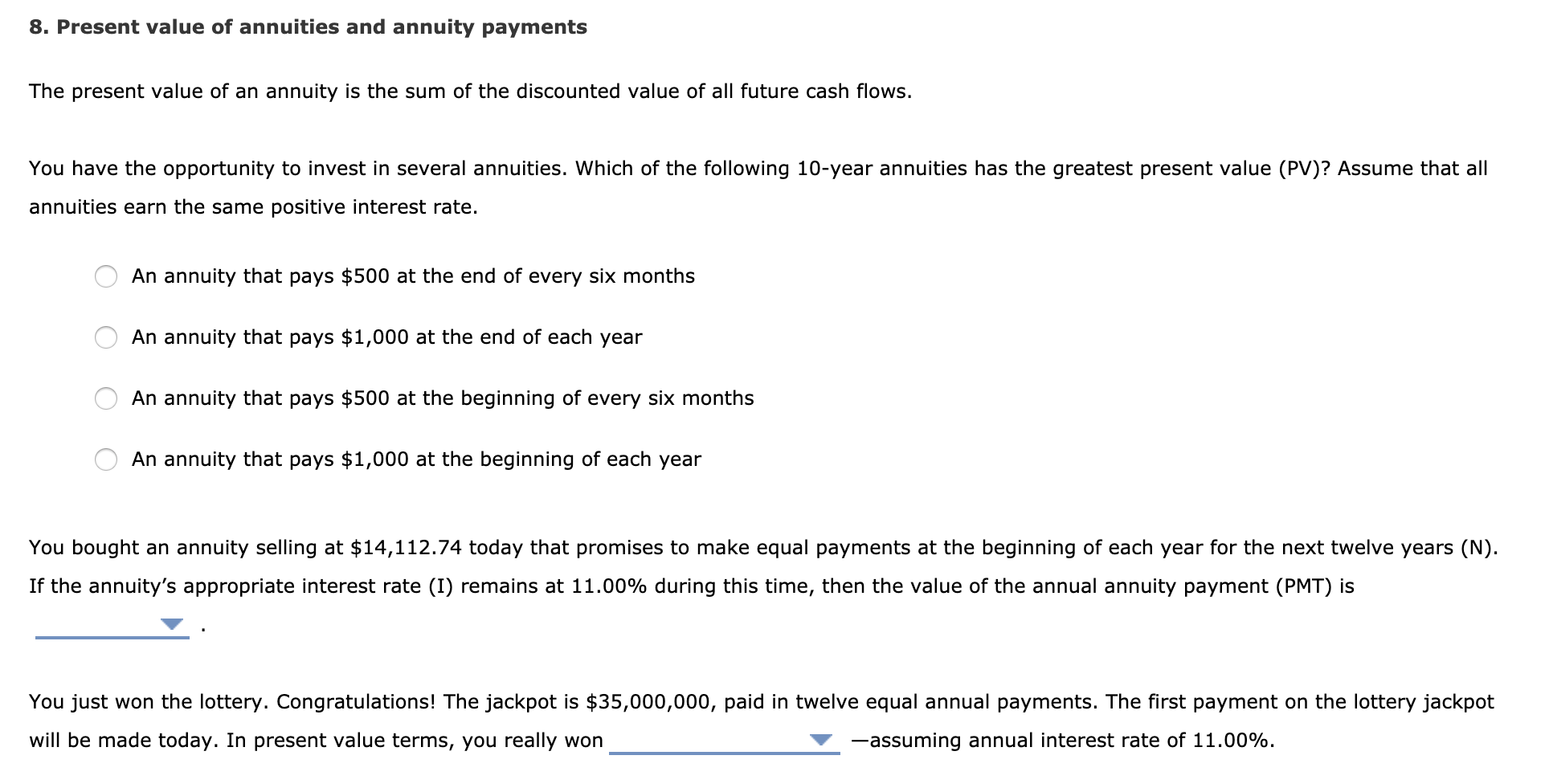

Which of the following 10-year annuities has the greatest present value PV. The present value of an annuity is the sum of the discounted value of all future cash flows. An annuity that pays 400 at the end of every 6 months C.

An annuity that pays 1000 at the beginning of each year. Which of the following 10-year annuities has the greatest present value PV. An annuity that pays 1000 at the beginning of each year An annuity that pays 500 at the beginning of every six months An annuity that pays 1000 at the.

Assume that all annuities earn the same positive interest rate. Which of the following 10-year annuities has the greatest present value PV. You have the opportunity to invest in several annuities.

View the full answer. Surrender periods vary from 2 years to. Which of the following 10-year annuities has the greatest present value PV.

100 1 rating Sol. Assume all the annuities have the same interest rate. If you are healthy and expect to lack a reliable income stream in retirement it definitely makes sense to investigate annuities.

Assume that all annuities earn the same positive interest rate. Which of the following 10-year annuities has the lowest present value. Humans have a tendency.

You have the opportunity to invest in several annuities. An annuity that pays 1000 at the beginning of each year. Assume that all annuities earn the same positive interest rate.

Which of the following 10-year annuities has the greatest present value PV. The present value of an annuity is the sum of the discounted value of all future cash flows. Assume that all annuities earn the same positive interest rate.

B An annuity that pays 500 at the end of every six months. An annuity that pays 500 at the end of every six months An annuity that pays 1000 at the end of each year An annuity that pays 1000 at the beginning of each year An. O An annuity that pays 1000 at the beginning of each year O An annuity that pays 500 at the end of every six months O An annuity that pays 1000 at the end.

You have the opportunity to invest in several annuities. You have the opportunity to invest in several annuities. You have the opportunity to invest in several annuities.

Also like CDs MYGAs and other deferred annuities have surrender charges if you withdraw your money early. Which of the following 10-year annuities has the greatest present value PV. Annuities may have early withdrawal penalties.

Solved You Have The Opportunity To Invest In Several Chegg Com

How To Invest For Annuities With Commercial Real Estate It Can Be A Lot Easier Than You Think In 2021 Commercial Real Estate Real Estate Real Estate Tips

Annuity Formula Calculation Examples With Excel Template

Solved You Have The Opportunity To Invest In Several Chegg Com

No comments for "You Have the Opportunity to Invest in Several Annuities"

Post a Comment